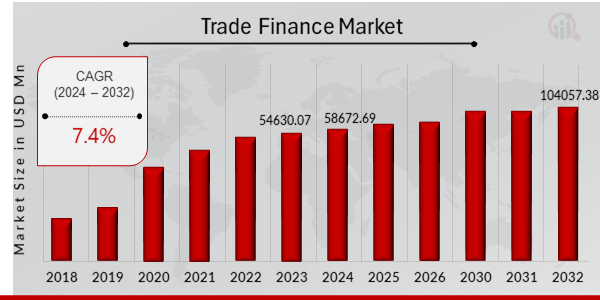

Trade Finance Market Expanding at a Healthy 7.4% CAGR, To Reach a Value of US$ 104057.38 Million by 2032

Trade Finance Market Growth

Trade Finance Market Research Report By, Financing Type, Transaction Size, Industry Vertical, Digitalization Level, Regional

OK, UNITED STATES, March 20, 2025 /EINPresswire.com/ -- The global Trade Finance market has witnessed significant growth in recent years and is expected to expand further over the coming decade. The market size was estimated at USD 54,630.07 million in 2023 and is projected to grow from USD 58,672.69 million in 2024 to an impressive USD 104,057.38 million by 2032, exhibiting a compound annual growth rate (CAGR) of 7.4% during the forecast period (2024–2032). The market's expansion is primarily driven by the rise in global trade activities, increasing demand for risk mitigation solutions, and advancements in digital trade finance solutions.

Key Drivers Of Market Growth

Rise in Global Trade Activities The increasing volume of international trade, fueled by globalization and expanding supply chains, is a key factor driving the trade finance market.

Increasing Demand for Risk Mitigation Solutions Businesses engaged in cross-border transactions rely on trade finance solutions to mitigate risks associated with currency fluctuations, political instability, and credit defaults.

Advancements in Digital Trade Finance Solutions The adoption of blockchain, AI, and cloud-based trade finance platforms is transforming the industry by enhancing transparency, reducing processing time, and improving efficiency.

Supportive Government Policies and Regulations Governments and financial institutions are actively promoting trade finance solutions to facilitate economic growth, particularly in emerging markets.

Download Sample Pages - https://www.marketresearchfuture.com/sample_request/24698

Key Companies in the Trade Finance Market Include

• Barclays Bank

• BNP Paribas

• HSBC

• JPMorgan Chase Co

• Deutsche Bank

• UBS

• Standard Chartered Bank

• Societe Generale Corporate Investment Banking

• Royal Bank of Scotland

• ING

• Bank of America Merrill Lynch

• Mizuho Financial Group

• Credit Agricole Corporate and Investment Banking

• Citigroup

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/trade-finance-market-24698

Market Segmentation To provide a comprehensive analysis, the Trade Finance market is segmented based on product type, provider, end-user, and region.

1. By Product Type

• Letter of Credit (LC): Ensures secure transactions between buyers and sellers in international trade.

• Supply Chain Finance: Enhances working capital efficiency by optimizing cash flows.

• Documentary Collection: Facilitates international trade by securing payments through banking channels.

• Factoring: Enables businesses to improve liquidity by selling accounts receivable.

• Export Credit: Supports exporters with financial assistance to expand international trade.

2. By Provider

• Banks: Leading providers of trade finance solutions to businesses of all sizes.

• Trade Finance Companies: Specialized firms offering customized financial solutions.

• Export Credit Agencies: Government-backed entities that support international trade activities.

3. By End-User

• Small and Medium Enterprises (SMEs): Increasing reliance on trade finance solutions to expand international business.

• Large Enterprises: High adoption due to complex supply chains and global trade operations.

4. By Region

• North America: Leading market due to strong financial infrastructure and advanced digital trade finance solutions.

• Europe: Growth driven by increasing trade volumes and regulatory support for trade finance.

• Asia-Pacific: Fastest-growing region, fueled by rapid industrialization and expanding export activities.

• Rest of the World (RoW): Emerging markets in Latin America, the Middle East, and Africa witnessing steady demand for trade finance solutions.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=24698

The global Trade Finance market is set for significant growth, driven by the rising volume of international trade, increasing demand for risk mitigation solutions, and the adoption of digital trade finance platforms. As businesses continue to expand their global operations, the demand for efficient and secure trade finance solutions is expected to surge across various industries and regions.

Related Report:

Compulsory Third Party Insurance Market

https://www.marketresearchfuture.com/reports/compulsory-third-party-insurance-market-23867

Credit Intermediation Market

https://www.marketresearchfuture.com/reports/credit-intermediation-market-23877

Financial Consulting Software Market

https://www.marketresearchfuture.com/reports/financial-consulting-software-market-23902

Investor Esg Software Market

https://www.marketresearchfuture.com/reports/investor-esg-software-market-23872

Mpos Terminals Market

https://www.marketresearchfuture.com/reports/mpos-terminals-market-23919

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Visit us on social media:

Facebook

X

LinkedIn

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release